The Ultimate Guide to Series Funding for Startup Founders

Understanding Series Funding: A Step-by-Step Breakdown

Series funding is a form of venture capital investment provided to startups in multiple stages or “series,” enabling them to grow from idea to expansion. Each round corresponds to specific business milestones.

Key Features of Series Funding

- Company valuation is based on:

- Business stage

- Negotiation with investors

- Size of the investment

- Market potential and financials

- Regular investor updates are expected, including:

- Financial statements

- Business performance metrics

- Strategic plans

- Investors may participate in multiple rounds if progress is promising.

Benefits of Series Funding

- Access to large capital

- No repayment obligations (unlike loans)

- Reduced risk through shared ownership

- Investor networks and strategic guidance

- Public exposure and brand credibility

- Future funding support from early investors

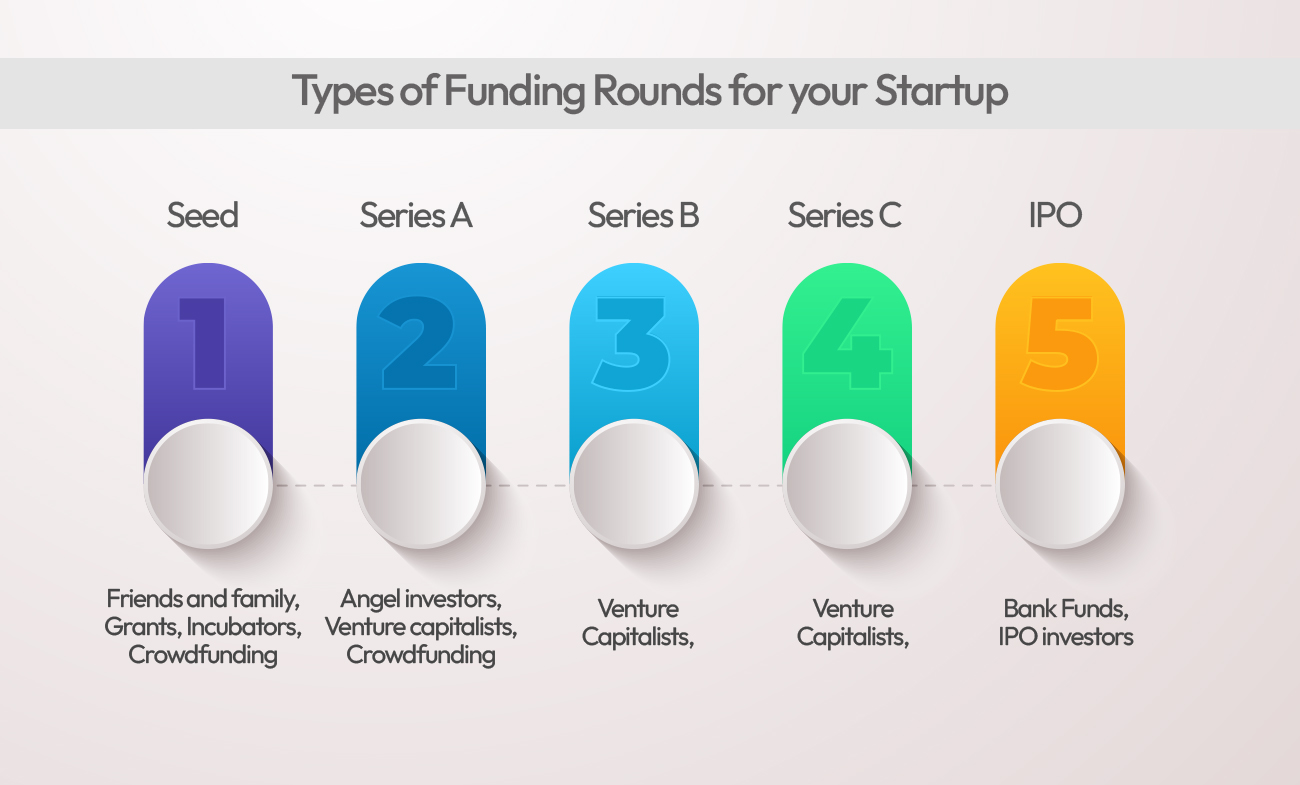

Funding Rounds Explained

Seed Funding: The Foundation

- Purpose: To develop an idea into a working business

- Investors: Angel investors, seed-stage VCs, or incubators

- Usage:

- Product R&D

- Market research

- Hiring initial team

- Risk Level: High, due to unproven business model

- Key Benefit: Opens access to mentorship, investor networks, and early validation

The actual funding amount varies depending on industry, business stage, and investor negotiations.

Series A Funding: Validating the Model

- Stage: Early traction and product-market fit

- Funding Size: Typically $10M–$15M

- Investors: Established VCs like Sequoia Capital, Google Ventures

- Goals:

- Build scalable infrastructure

- Prove sustainable revenue model

- Expand core team

How to Secure Series A:

- Join an accelerator for mentorship and early funding

- Expand and maintain a strong investor network

- Demonstrate consistent growth metrics

Series B Funding: Scaling Up

- Stage: Growth and expansion

- Purpose: Boost operations, customer base, and marketing reach

- Usage:

- Sales and marketing

- Hiring specialists

- Enhancing product features

- Investors:

- Strategic investors (large corporations, institutions)

Strategic investors bring not just funding, but partnerships and valuable resources.

Series C Funding: Accelerated Growth

- Stage: Proven business, ready to scale massively

- Purpose:

- Enter new markets

- Acquire competitors

- Launch new products

- Investors:

- Investment banks

- Hedge funds

- PE firms

At this stage, startups are considered lower-risk, high-growth investments.

Series D (and Beyond): Pre-IPO or Strategic Rounds

- When Needed:

- Additional capital before IPO

- Expansion opportunities post-Series C

- Desire to remain private longer

- Purpose:

- Strengthen market position

- Explore acquisition or IPO options

- Maximize business potential

Only select companies go beyond Series D, often with long-term vision or complex growth plans.

Final Thoughts

Raising venture capital is about more than just money—it’s about choosing the right partners, setting clear goals, and executing with precision. Start with a clear vision, know your funding needs, and approach investors with confidence.